Ancora fresca è la diffusione dell’analisi di Jim Reid (credit strategist di Deutsche Bank), intitolata The Start of the End of Fiat Money, nella quale egli sostiene che le valute fiat, cioè quelle stampate dalle varie banche centrali degli Stati, hanno ormai i giorni contati.

Le criptovalute come strumento di pagamento nell’eCommerce

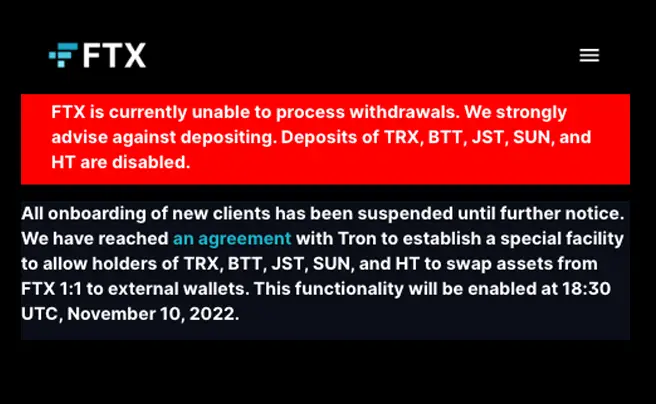

Le criptovalute, i pagamenti e l’eCommerce sono temi sempre più presenti nella nostra società digitale. Negli ultimi anni, infatti, si è assistito ad un’esplosione di nuovi strumenti di pagamento basati su tecnologie innovative come la blockchain. Questo ha portato ad una rivoluzione nel settore dei pagamenti online, rendendo possibile effettuare transazioni in modo rapido, sicuro … Leggi tutto